Disclaimer:

This blog, "Healthcare Risk: The Profitability Challenge – Can AI/ML Help?", was originally published on LinkedIn on May 20, 2024.

Healthcare organizations today are continuously seeking opportunities to lift margins in the midst of increasing financial challenges. NewCare IPA is one example of an independent physician organization that has pursued an innovative approach to applying artificial intelligence transforming their business. NewCare IPA is engaged in a two-sided global risk contract for a Medicare population of 40,000 lives. James Kirk, MD, CEO of NewCare IPA, set an enterprise goal of “3% increase in profitability” for their executive team in the calendar year 2024 / 2025 during an annual kick-off meeting. Throughout the meeting, executive team members engaged in discussing many approaches for increasing profitability; however, each idea for margin improvement resulted in a question without a clear approach to obtaining answers.

Figure 1: A few questions coming out of the NewCare Executive Meeting

Click here to look at all the questions that came up in the NewCare executive meeting.

The same dilemma is playing out in healthcare boardrooms throughout the US, leaving executives frustrated by their inability to pursue their goals optimally. Answering this plethora of questions was at the heart of improving NewCare’s profitability by 3%. So, how did they accomplish their goal?

Leveraging Data to Address Questions

Data is prevalent in healthcare, but having the data is not sufficient. It must be transformed to discover actionable insights, allowing for action on those insights. Then, executives need to be able to assess the impact of those actions; however, these steps require complex analysis and sophisticated problem-solving. Optimizing margins in a healthcare enterprise is an intricate exercise that involves business models, process models, data-driven insights, process modification, and value tracking. As an example, let us assess one of the questions from Figure 1 above: “Are my inpatient claims cost appropriate? How can I reduce inpatient expense?” and explore the optimization process.

A global risk-bearing organization (RBO) like NewCare IPA not only covers outpatient visits for its members but also covers the cost of hospitalizations. Hospitalizations are recognized as the largest component of expense in risk contracts. Authorizing hospitalizations and then adjudicating hospital claims is a costly and complex process. It involves multiple checks, including eligibility, medical necessity, medical coding correctness, clinical documentation correctness, appropriateness of levels of care, and DRG coding correctness, among other areas.

The questions “Are my inpatient claims cost appropriate? and “How can I reduce inpatient expense?” are first answered by comparing the number of hospital admissions per 1,000 members against the national benchmarks. If numbers are higher, organizations need to take two key actions.

- Review and re-adjudicate thousands of inpatient claims for medical necessity and coding accuracy.

- Address any appeals that come back from hospitals after adjudication or re-adjudication.

NewCare's 40,000 patients can expect about 4000 – 6000 admissions per year, depending on where in the US those patients live. This translates to 500 claims per month. Doing a thorough adjudication of 500 claims requires a time commitment from an Authorizations Expert, a DRG Coding Expert, a Medicare Rules Expert, a Clinician, and a Data Analyst working with an IT system to examine claims and request medical records where necessary. The salary expense of such a team could run ~$1M+ annually, which is prohibitively expensive to NewCare IPA.

Leveraging AI-Driven Augmented Intelligence

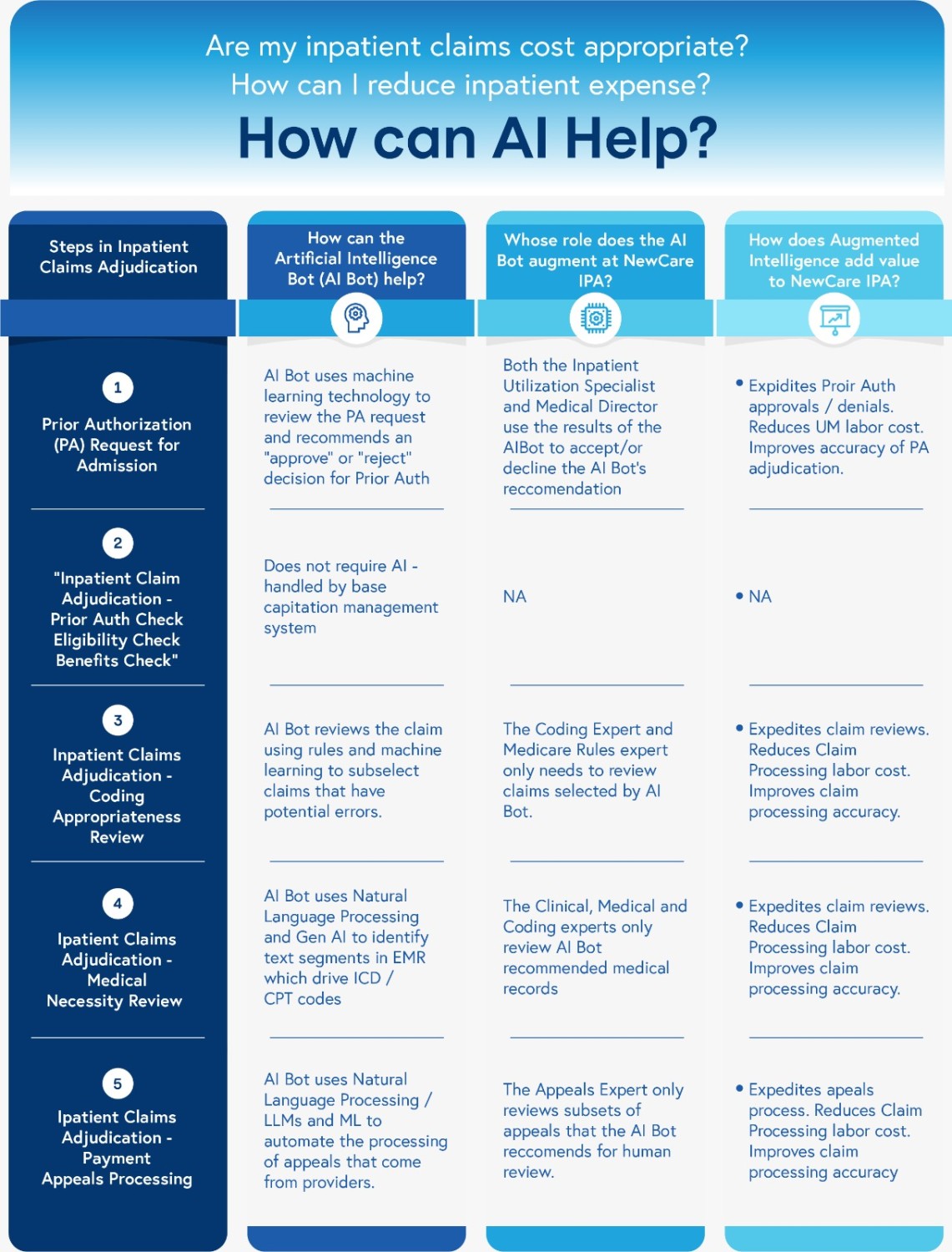

The good news is that with the advent of Artificial Intelligence (AI) transformational solutions can be applied to address the questions and challenges faced by healthcare organizations. As a first step, we can deploy a solution that reduces the workload of the inpatient claims process by delivering AI-Driven augmented intelligence. To understand the landscape of applying this solution, Figure 2 lays out each step in the inpatient claims adjudication process. It begins at the prior authorization request for admission and transitions through the payment appeals process with AI playing a role in all the key steps.

For example, let us take a look at Step 3 of Figure 2 “Inpatient Claims Adjudication – Coding Appropriateness Review.” The goal of this step is to determine if every inpatient claim submitted to NewCare is appropriately coded with each representing the medical record accurately complying with Medicare rules. We will outline two scenarios for how this step is executed today without AI and how AI can transform the workflow.

Coding Appropriateness Review Without AI: An accomplished coder can review, on average, 4 cases per hour from a denials perspective. They typically perform two steps to determine the appropriateness of coding leading to an incredibly time-consuming process.

- Step 1 - Claim Review: They review each and every claim to examine multiple parameters such as alignment of admitting and principal diagnosis, appropriateness of diagnoses to DRGs and DRG severity appropriateness. After examining these parameters, the coding expert selects a subset of claims which could involve 200 of 500 for EMR review.

- Step 2 - EMR Review: The coding expert now logs into the EMR to review 10’s pages of documents, lab values, medications, diagnostic procedures, and more to decide if this claim has been appropriately coded. The expert will need to go through 200 to select 50 that move to the next step in the process.

Coding Appropriateness Review With AI: If the same coder were to be empowered with AI, they could review the 500 claims and associated medical records easily achieving 3x to 5x more reviews per hour with higher quality results. The AI-Driven augmented intelligence within the workflow will automatically select the claims exceptions that need to be reviewed and provide hints regarding where to focus. Here’s a little more on how these engines work.

- The AI-Driven Claims Exception Module: This module uses a combination of Machine Learning (ML) and coding rules to flag a much smaller subset of claims for further processing by the AI-Driven EMR Processing Module. The AI-Driven Claims Exception Module also provides hints or specific areas of the claim needing further investigation. These claims are passed onto the EMR Engine. Claims which are appropriately coded are not flagged by the AI engine.

- The AI-Driven EMR Processing Module: The EMR module uses the hints from the coding module to examine various aspects of the EMR related to the specific hints provided by the claims module. This module further narrows down the claims that the coding expert has to review from 200 to down to 50.

Figure 2 shows all of the steps and how AI can help all of the roles in the inpatient claims adjudication process.

Figure 2: how AI can help all of the roles in the inpatient claims adjudication process.

NewCare IPA Drives Profitability with Next-Generation AI

So, let us step back and assess how AI is helping NewCare, specifically in the claims adjudication process. With the intelligent claims adjudication solution, NewCare is now able to review claims without taking on an additional $1M+ headcount to staff this process. And, given the accelerated reviews, NewCare is seeing a 5%-10% reduction in claims expense. As the NewCare CEO and executive team become familiar with the power of AI in their processes, they are considering using AI across many areas, including but not limited to Risk Adjustment, Utilization Optimization, Cost Optimization, and more. Many of the challenges faced across different sections of healthcare industry can be effectively addressed using AI, adding huge value to a healthcare organization such as NewCare IPA.